Snag Ultimate Savings with Best Cash Back Credit Cards

Unlock your financial potential and maximize your savings by exploring the best cash back credit cards available today—browse options to find the perfect match for your spending habits and start earning rewards now.

Understanding Cash Back Credit Cards

Cash back credit cards offer a simple yet effective way to earn rewards on your everyday purchases. Unlike points or miles, cash back is straightforward; you earn a percentage of your spending back in cash, which can be applied as a statement credit, direct deposit, or even a check. This makes cash back cards an attractive option for those who want tangible rewards without the complexity of travel rewards programs.

How Cash Back Works

When you use a cash back credit card, a percentage of each purchase is returned to you. Typically, cash back rates range from 1% to 5%, depending on the card and the type of purchase. Some cards offer a flat rate on all purchases, while others provide higher rates in specific categories, such as groceries, dining, or travel. For example, the Citi® Double Cash Card offers 2% cash back—1% when you buy and 1% when you pay off those purchases1.

Maximizing Your Cash Back

To make the most of your cash back card, strategically use it for purchases that align with its highest reward categories. Additionally, some cards offer rotating bonus categories that change each quarter, requiring cardholders to activate them to earn the extra rewards. For instance, the Chase Freedom Flex℠ card offers 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate2.

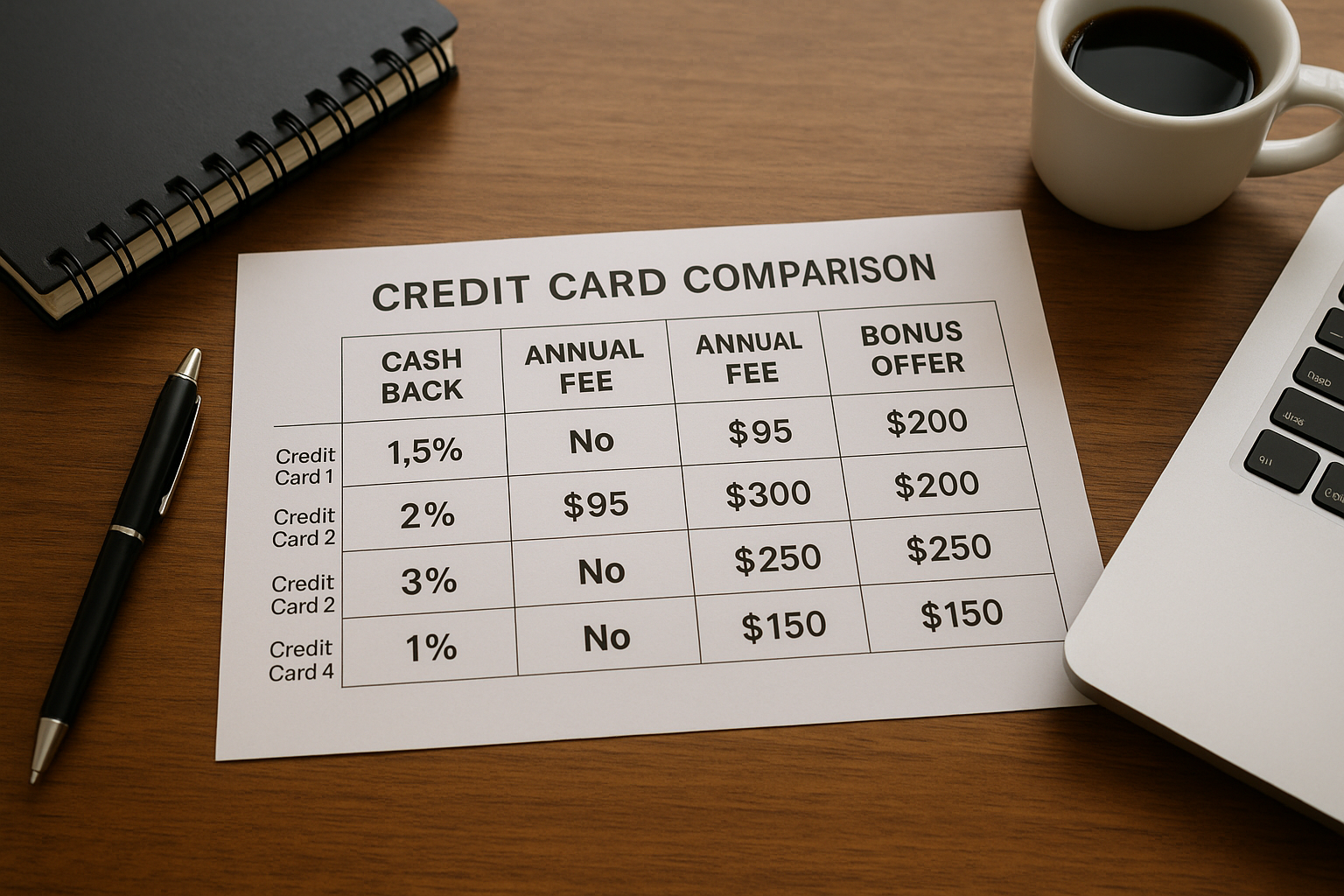

Comparing Cash Back Credit Cards

With numerous cash back credit cards available, it's essential to compare their features to find the best fit for your lifestyle. Consider factors such as:

- Cash Back Rate: Look for cards with high cash back rates in categories you frequently spend in.

- Annual Fees: Some cards charge annual fees, which can offset your rewards if not managed carefully. However, cards like the Discover it® Cash Back have no annual fee3.

- Introductory Offers: Many cards offer sign-up bonuses for spending a certain amount within the first few months. The Blue Cash Preferred® Card from American Express, for example, offers a $250 statement credit after you spend $1,000 in purchases on your new card within the first 3 months4.

Benefits Beyond Cash Back

Cash back credit cards often come with additional perks, such as purchase protection, extended warranties, and travel insurance. These benefits can add significant value, especially if you frequently travel or make large purchases. It's worthwhile to review these features when selecting a card, as they can provide peace of mind and additional savings.

Exploring Additional Resources

For those interested in specialized options or further details, many financial institutions offer comprehensive guides and comparison tools on their websites. By visiting these resources, you can gain deeper insights into the specific terms and conditions of each card, helping you make an informed decision that aligns with your financial goals.

Unlock the full potential of your spending by choosing a cash back credit card that complements your lifestyle and financial habits. As you explore these options, you'll find opportunities to enhance your savings and enjoy the benefits of a well-chosen credit card.