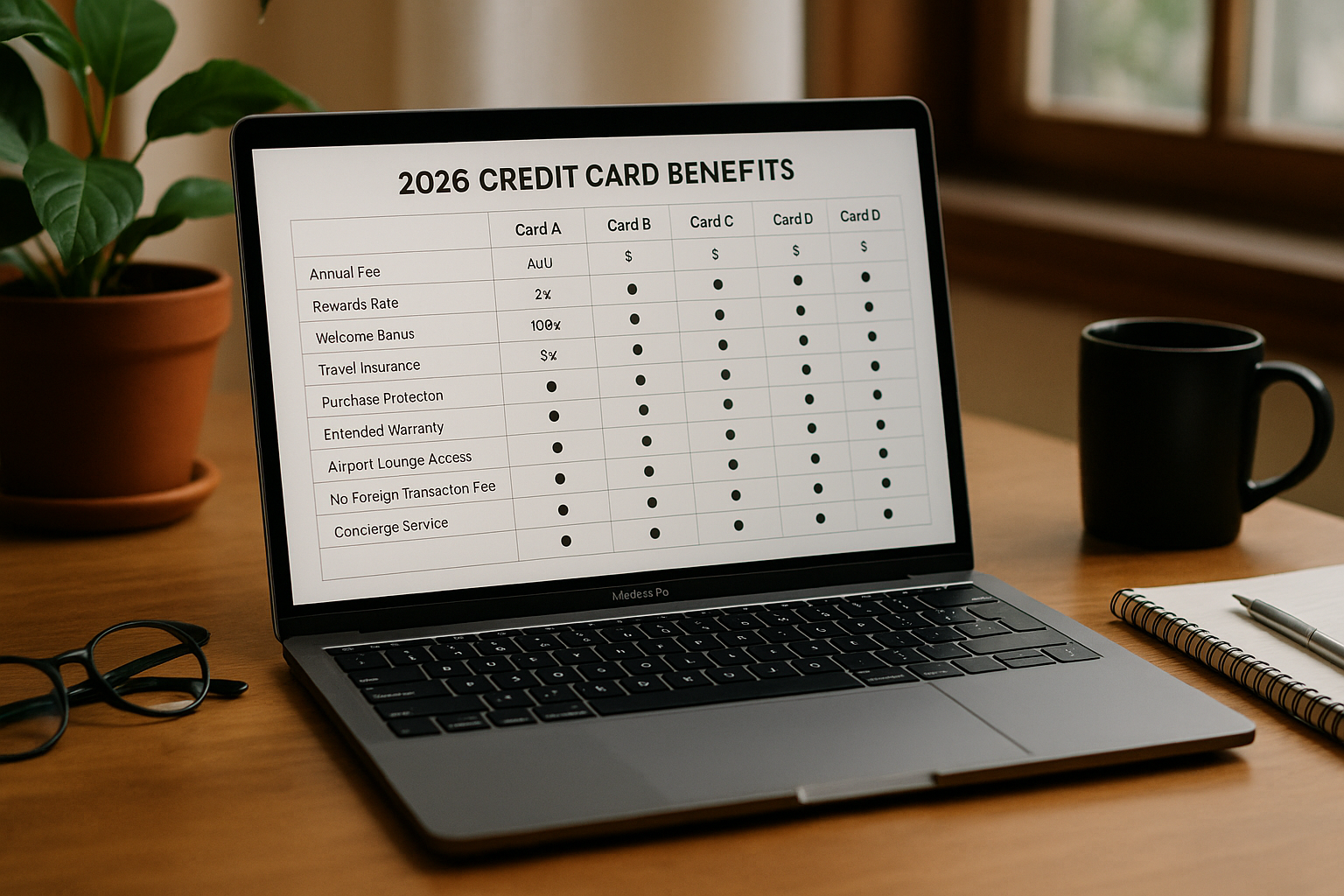

Grab 2026's Ultimate Credit Card Benefits List Now

Unlock the secrets to maximizing your financial perks with the ultimate credit card benefits list for 2026, and as you explore these options, you'll discover how to elevate your financial game with unparalleled rewards and savings.

The Evolution of Credit Card Benefits

Credit cards have evolved significantly over the years, transforming from simple payment tools into powerful financial instruments offering a plethora of benefits. As we approach 2026, credit card issuers are competing fiercely to attract savvy consumers like you by offering enticing perks. These benefits range from cashback rewards and travel miles to exclusive access to events and premium services. By understanding and leveraging these benefits, you can optimize your spending and enhance your financial well-being.

Cashback and Reward Programs

One of the most sought-after features of modern credit cards is the cashback and rewards programs. These programs allow you to earn a percentage back on your purchases, effectively reducing the cost of your expenses. For instance, many cards offer up to 5% cashback on specific categories such as groceries, dining, or fuel1. Additionally, some cards provide points for every dollar spent, which can be redeemed for travel, merchandise, or even statement credits.

Travel Benefits

For frequent travelers, credit cards with travel benefits are indispensable. These cards often offer perks such as free checked bags, priority boarding, and access to airport lounges. Moreover, travel credit cards typically include travel insurance, which can cover trip cancellations, lost luggage, and medical emergencies while abroad2. By utilizing these benefits, you can enjoy a more comfortable and secure travel experience while saving money on additional travel-related expenses.

Exclusive Access and Premium Services

In 2026, credit card issuers are expected to continue offering exclusive access to events and premium services as a way to differentiate their products. These benefits can include invitations to VIP events, early access to concert tickets, and special dining experiences. Furthermore, some high-end cards provide concierge services, which can assist with booking reservations, securing hard-to-get tickets, and arranging travel plans. These services add significant value for cardholders seeking unique experiences and convenience3.

Financial Security and Protection

Beyond rewards and perks, credit cards also offer financial security and protection features. Many cards include purchase protection, which covers items that are damaged or stolen shortly after purchase. Additionally, extended warranty protection can extend the manufacturer's warranty on eligible purchases4. These protections provide peace of mind and can save you money by reducing the need to purchase additional insurance or warranties.

Maximizing Your Benefits

To fully capitalize on the benefits available in 2026, it's crucial to select a credit card that aligns with your lifestyle and spending habits. Consider factors such as your typical spending categories, travel frequency, and desired perks. By doing so, you can ensure that you are maximizing the value of your credit card. Additionally, it's wise to regularly review your card's benefits and stay informed about any changes or new offers. This proactive approach will help you continue to reap the rewards and advantages of your credit card.

As you browse options and explore these opportunities, remember that the right credit card can be a powerful tool for enhancing your financial health and lifestyle. By understanding and leveraging the benefits available, you can enjoy greater savings, security, and access to exclusive experiences.