Refinance Your Mortgage Save Thousands Every Month Effortlessly

Imagine saving thousands of dollars every month on your mortgage with just a few simple steps—browse options today to unlock these savings opportunities.

Understanding Mortgage Refinancing

Refinancing your mortgage involves replacing your existing loan with a new one, usually with better terms. The primary goal is to reduce your monthly payments, which can be achieved through a lower interest rate or extending the loan term. By refinancing, you can capitalize on current market conditions, potentially saving thousands over the life of your loan.

Why Refinance Now?

Interest rates fluctuate due to economic conditions, and when they drop, homeowners have a unique opportunity to refinance at a lower rate. For instance, if you secured your mortgage at a 4.5% interest rate and current rates are at 3%, refinancing could significantly reduce your monthly payments. Moreover, with the Federal Reserve's recent decisions to keep rates low, now is an ideal time to explore refinancing options1.

Potential Savings from Refinancing

The amount you can save by refinancing depends on several factors, including your current interest rate, the new rate, and the remaining balance on your mortgage. For example, refinancing a $300,000 mortgage from 4.5% to 3% could save you over $250 a month, translating to $3,000 annually2. Over a 30-year term, these savings can add up to tens of thousands of dollars.

Types of Refinancing

There are several types of refinancing options available, each catering to different needs:

- Rate-and-Term Refinance: This is the most common type, where the main goal is to get a lower interest rate or change the loan term.

- Cash-Out Refinance: Allows you to borrow more than you owe on your home, providing cash for other expenses like home improvements or debt consolidation.

- Cash-In Refinance: Involves paying down your mortgage balance to qualify for better terms.

Choosing the right type depends on your financial goals and current situation. Consulting with a financial advisor can help you determine the best option for your needs.

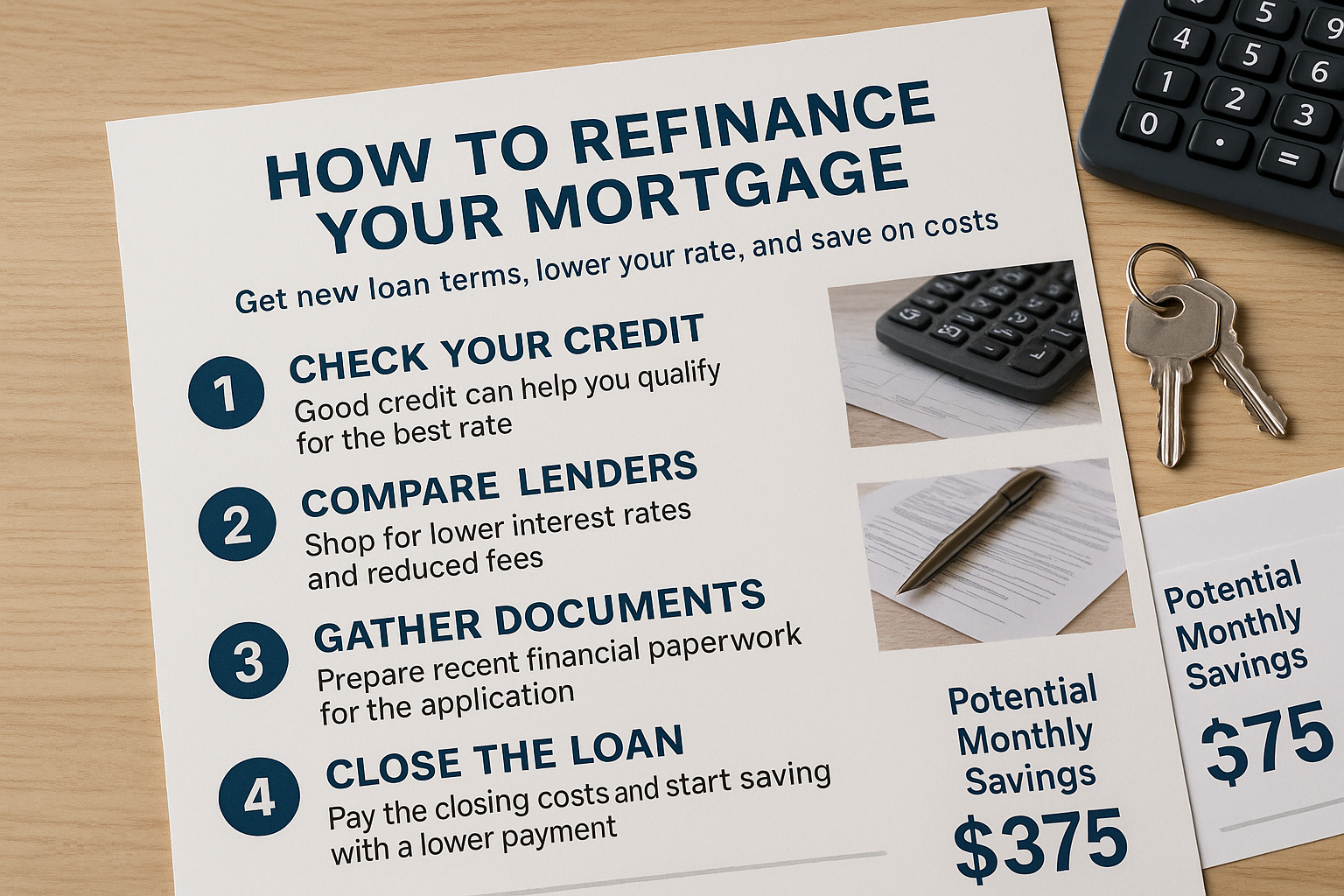

Steps to Refinance Your Mortgage

- Assess Your Financial Situation: Check your credit score, income, and debt-to-income ratio to ensure you qualify for better rates.

- Shop Around for Lenders: Compare offers from different lenders to find the best terms. Visit websites and browse options to see these opportunities.

- Apply for the New Loan: Once you select a lender, submit your application with the necessary documentation, such as income verification and tax returns.

- Close on the Loan: After approval, review the loan terms and sign the final paperwork to complete the refinancing process.

Real-World Examples and Benefits

Homeowners across the country have successfully reduced their monthly payments through refinancing. For instance, a family in California refinanced their $400,000 mortgage from 4.75% to 3.25%, saving over $400 monthly3. These savings can be redirected towards other financial goals, such as retirement savings or college funds.

Additionally, refinancing can provide stability by switching from an adjustable-rate mortgage to a fixed-rate mortgage, protecting against future rate increases.

To explore your refinancing options and see how much you could save, consider visiting specialized services that offer personalized rate comparisons and expert advice.

References

By taking the time to research and act on refinancing opportunities, you can enjoy substantial financial benefits. Start your journey today by exploring various options and consulting with experts to tailor the best solution for your needs.